Guaranteed life insurance is a purpose-built product to help insure those without access to traditional underwriting. As this product is designed to insure high-risk individuals, there are a lot of questions regarding who it is best for and why the premiums are higher than other products. Today we ask several professionals:

- When is it best to look into a guaranteed issue plan?

- What tips can you share, to qualify for lower guaranteed life insurance rates?

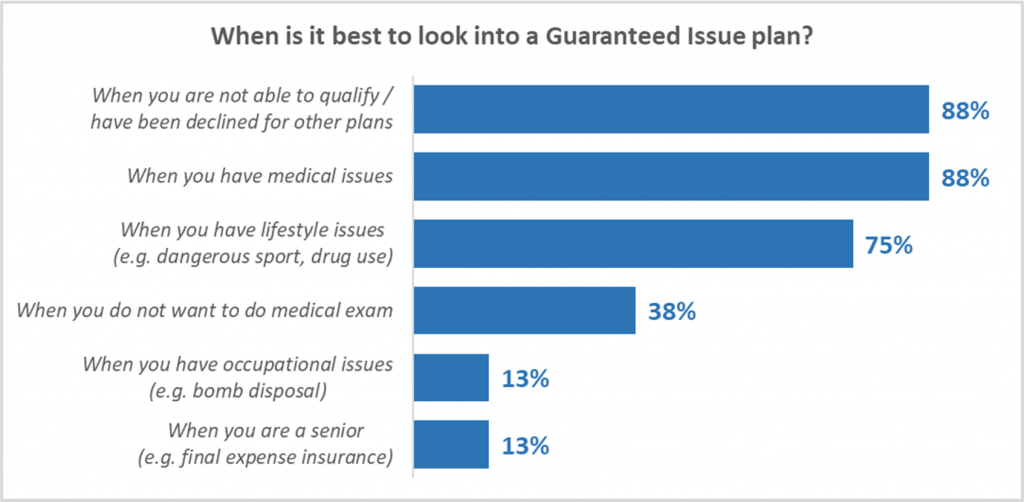

A summary of their replies is below, with more detailed explanations following in the corresponding sections (the percentage % shows how often a particular answer has been mentioned).

Ready to learn more about guaranteed issue insurance? Let’s get started.

Question #1: When is it best to look into a Guaranteed Issue plan?

The top three answers were:

- When you have medical issues impacting your insurability

- When you are not able to qualify or have been declined for other plans like traditional or simplified insurance

- When you have lifestyle issues impacting your insurability (e.g. dangerous sports, drug use)

Question #2: What tips can you share on how to qualify for lower guaranteed life insurance rates?

The top three answers were:

- Use an independent broker to compare the plans for you

- Before going for guaranteed, ensure that you do not qualify for simplified

- Don’t buy guaranteed insurance directly without comparing all your options and comparing a variety of guaranteed products. Coverage and premiums vary even for similar products